From Boom to Balance: 7 Market Shifts Defining 2025

- Buffet Online School

- Jan 21

- 2 min read

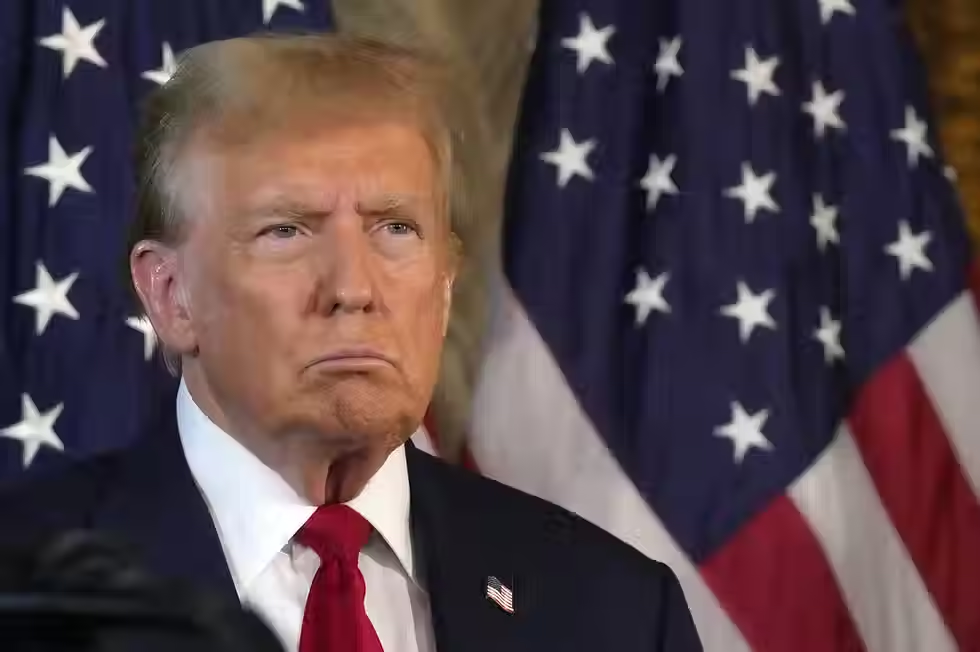

The stock market has entered a phase unlike anything seen before. As President-elect Donald Trump prepares for his second term, the economic landscape is buzzing with activity, from record-breaking stock performances to global economic shifts.

Let’s explore what sets today’s market apart from the rest.

1. Two Years of Historic Growth

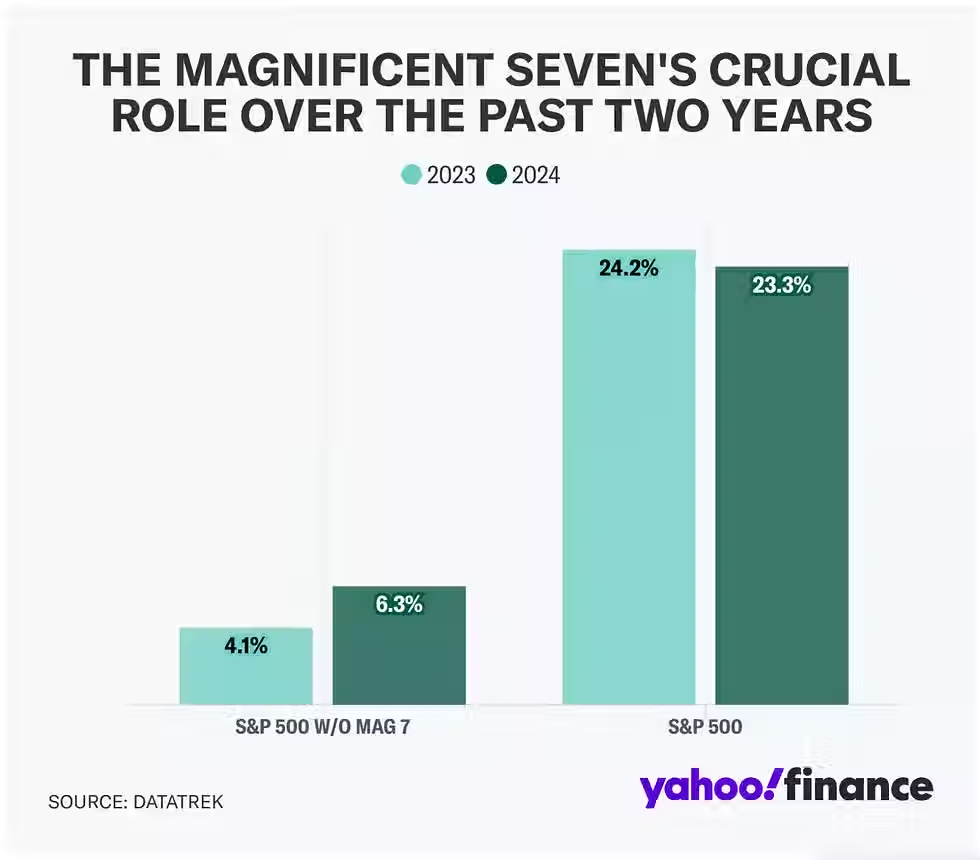

The S&P 500 has achieved something remarkable: back-to-back annual gains of over 20% in 2023 and 2024. This hasn't happened since 1997-1998.

The Federal Reserve played a major role, cutting interest rates three times in 2024, making borrowing cheaper for businesses and consumers alike.

Add to that the excitement surrounding generative artificial intelligence, with companies like Nvidia and the "Magnificent Seven" driving investor optimism.

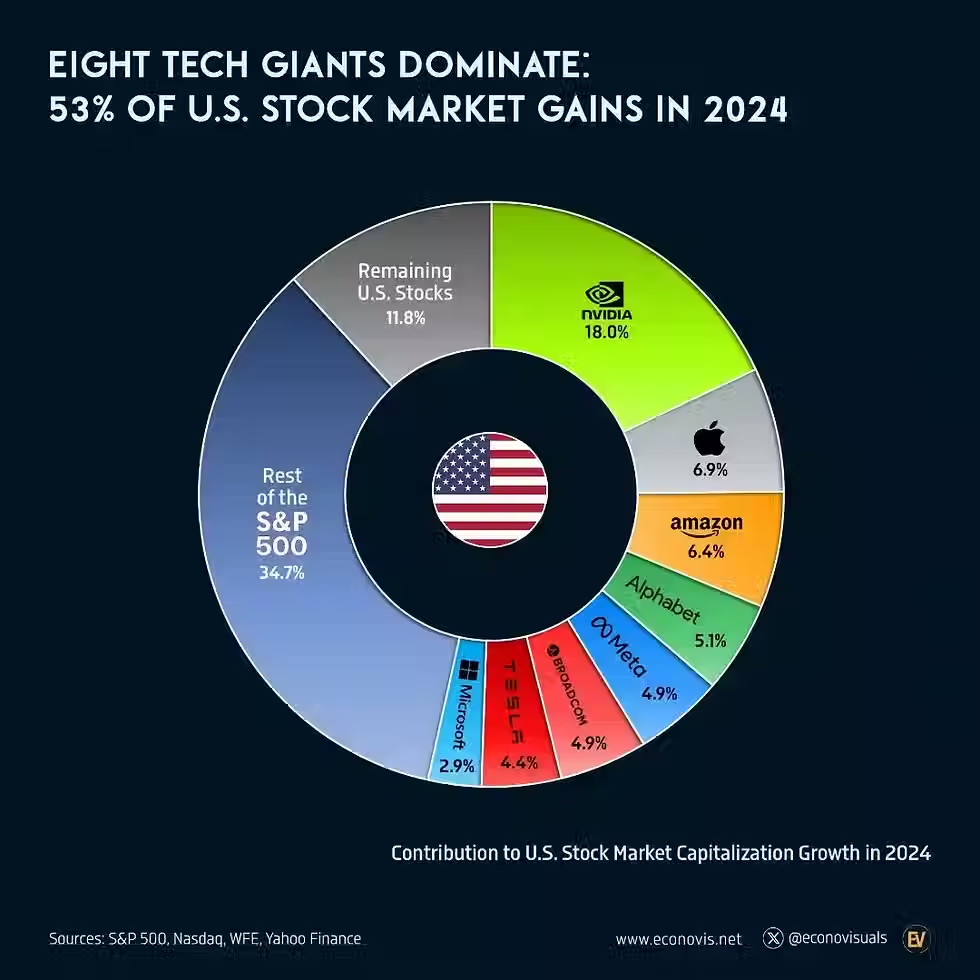

2. Concentration in Tech Dominance

A handful of tech giants now make up nearly 60% of the S&P 500. These companies, including Alphabet, Amazon, and Microsoft, have been pivotal in driving market gains. However, this heavy reliance on a few players poses risks, as any stumble by these companies could significantly impact the broader market.

3. Elevated Valuations Raise Questions

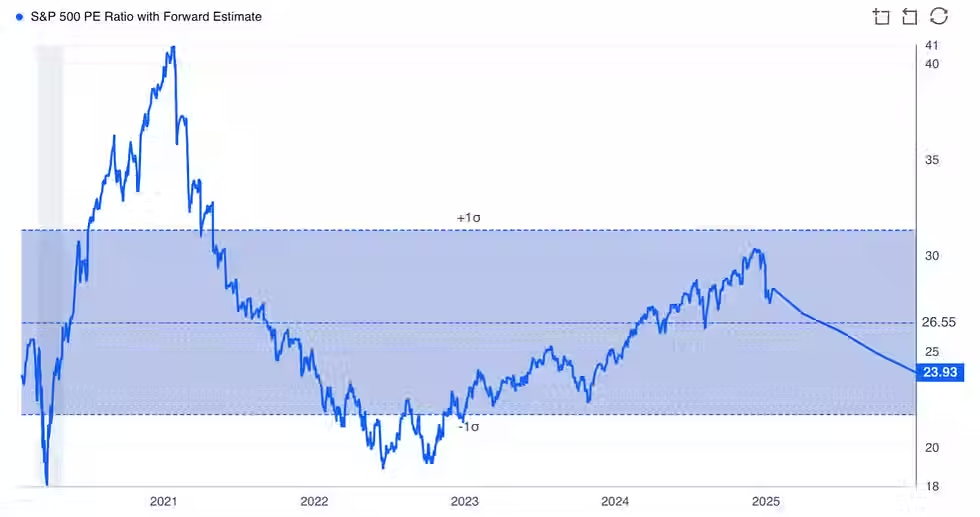

The S&P 500’s forward price-to-earnings (P/E) ratio stands at 23.93, well above the five- and ten-year averages.

Historically, such valuations have only been seen during speculative booms, like the dot-com bubble. While some analysts argue this reflects a shift toward asset-light, high-margin sectors like tech and healthcare, others caution about potential volatility.

4. Global Markets in Action

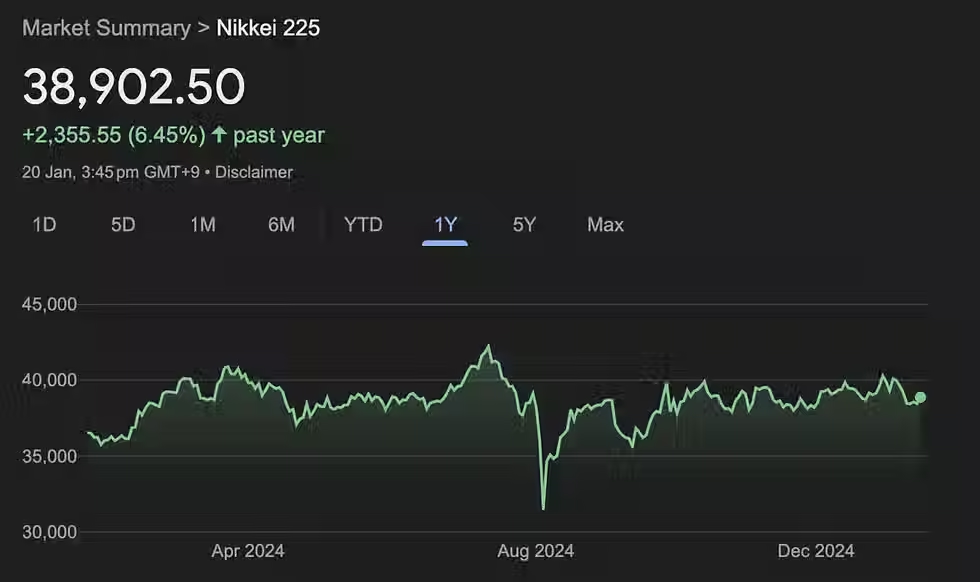

While U.S. stocks soar, global markets are also making waves. Asian indices like Hong Kong’s Hang Seng and Tokyo’s Nikkei have posted gains, supported by positive sentiment and economic resilience.

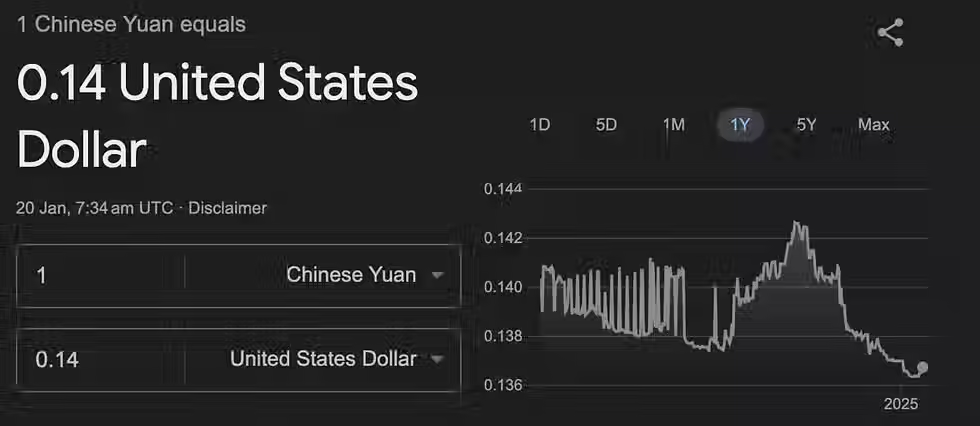

5. The Yuan’s Steady Decline

Meanwhile, China’s central bank is striving to stabilise its currency amidst pressures from a strong U.S. dollar.

The Chinese yuan has weakened against the dollar, reflecting diverging monetary policies. The People’s Bank of China (PBOC) is prioritising currency stability to avoid excessive volatility, even as it limits its ability to lower interest rates. This balancing act underscores China’s challenges in maintaining economic momentum.

6. Market Momentum Amid Uncertainty

Recent Federal Reserve rate cuts have fuelled optimism, easing economic pressures and boosting asset prices. Yet, questions remain about whether this momentum can continue. Inflation concerns and future rate decisions will be crucial in shaping market trends in 2025.

7. Trump’s Economic Policies Loom Large

President-elect Trump’s proposed tariffs and trade policies could reshape the economic landscape. Higher tariffs might fuel inflation, impacting market sentiment. While the full details remain unclear, these policies could bring both risks and opportunities for investors navigating this evolving environment.

Final Thoughts

The stock market is in a unique position, blending historical growth with looming uncertainties. As 2025 unfolds, all eyes are on economic policies, interest rate decisions, and the tech sector’s continued dominance. While the future remains uncertain, the present offers a fascinating snapshot of a market defying historical norms.

Comments