🚗💰Tesla’s Market Cap Reclaims $1 Trillion Market Cap: What the Post-Election Rally Means

- Buffet Online School

- Nov 21, 2024

- 3 min read

Following President-elect Donald Trump’s victory, U.S. stocks have experienced a notable rally, as investors adjust their portfolios to prepare for the potential impact of his second term. From Bitcoin to Tesla to the U.S. dollar, markets have shown broad-based gains.

But what’s behind this post-election surge, and what should investors keep an eye on moving forward?

Bitcoin and Tesla Lead the Charge

One of the most striking trends has been the surge in cryptocurrency and tech stocks. Bitcoin hit a record high of over $82,000 on Monday, fueled by optimism that Trump’s win will be a positive catalyst for digital assets. Investors have cheered the possibility of friendlier policies toward crypto markets under Trump’s leadership.

Tesla, too, saw impressive gains, with its stock rising more than 8% to $348.50. This jump helped the electric vehicle maker reclaim a $1 trillion market cap, a milestone it hadn’t reached since April 2022. Analysts, including Dan Ives, have raised their price targets for Tesla to $400 per share, citing Trump’s victory as a potential “game changer” for the company’s future growth.

Inflation Data and Corporate Earnings in Focus

While the market is celebrating, investors are closely watching economic data.

This week, inflation reports will be a key focus. The Consumer Price Index (CPI) for October is set to be released on Wednesday, with economists expecting a 2.5% year-over-year increase, up slightly from the previous month's 2.4%.

This will be followed by the Producer Price Index (PPI) on Thursday, which could offer additional insights into inflationary pressures.

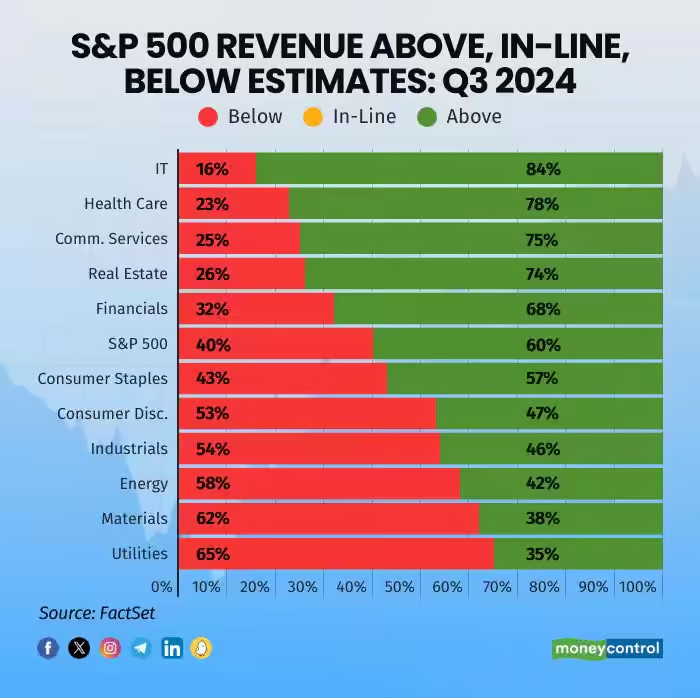

Corporate earnings, though winding down, are also under scrutiny. So far, 91% of S&P 500 companies have reported third-quarter results, with 77% beating profit estimates.

Analysts remain cautious, however, as inflation and interest rates rise.

Economic Concerns: Inflation and Trade Wars

Despite the post-election rally, not all experts are optimistic.

Peter Berezin, chief global strategist for BCA Research, warns that a U.S. recession is becoming more likely, with the probability now at 75%, up from 65% prior to the election.

One major concern is Trump’s trade policies, particularly his plans for universal tariffs on goods imported into the U.S. These tariffs could stifle corporate investment and reduce household incomes, potentially leading to a slowdown in economic growth.

Berezin points out that Trump's proposed tariffs, if implemented, could harm consumers by raising prices and reducing disposable income. A Yale study estimates that such tariffs could cost the median U.S. household between $1,900 and $7,600 annually.

Tax Cuts and Market Optimism

On the other hand, Trump’s proposed tax cuts could provide a boost to corporate earnings, with Goldman Sachs forecasting a 20% rise in S&P 500 earnings over the next two years. If Trump delivers on his promise to lower the corporate tax rate from 21% to 15%, this could further lift earnings per share for major U.S. companies.

However, not all analysts share this optimism. Goldman also warns that the potential for a new trade war and higher interest rates could dampen the stock market's long-term prospects. They predict a decade of slower returns for the S&P 500 due to inflationary pressures and high market valuations.

What Lies Ahead for Investors?

As U.S. stocks continue to rally post-election, investors face a complex mix of opportunities and risks. While sectors like cryptocurrency and tech are thriving, concerns about inflation, trade policies, and rising interest rates could weigh on future growth. With key economic data on the horizon, all eyes will be on how the market reacts to the challenges ahead.

Comments